Edinburgh Property Market Update

The story of the property market in Edinburgh in the last few years has been one of rapid price increases both in terms of property selling prices and monthly rents. The economic climate has had an impact on both sectors, with the short supply of rental properties keeping rental values strong and making buy-to-let an attractive prospect despite increasingly onerous regulation and taxation.

Mortgage Market

The volatility in the mortgage market throughout 2023, which was continually trying to keep pace with the ever-changing Bank of England base rate of interest, meant that there was a circa 10% reduction in the number of transactions completed in the city. Most folk, buyers and sellers alike, adopted a ‘sit tight and do nothing’ approach until it became clearer as to where the carousel might stop. Now that the base rate appears to have settled at 5.25%, it’s likely that 2024 will see an increase in transaction levels as activity looks to recover lost ground.

That said, it’s worth noting that the December BoE Monetary Policy Committee minutes show that three out of the nine members voted for a 0.25% increase, citing upside risks to inflation and an, as yet, unconvincing downward path towards the 2.0% long-run target. Nevertheless, broad expectations are for a steady decrease in the base rate from the end of 2024, declining gradually to circa 4.25% by the end of 2026.

Based on these forecasts, some lenders are already offering sub 5.0% Buy-To-Let rates on their 5 year fixed rate deals. This will likely help Buy-To-Let activity further in the coming months, as well as owner-occupier buyers. This increasing demand is expected to help property values increase again, albeit at lower percentage levels than in the last 5 years. A steadying of the market seems likely, but probably not a step backwards for Edinburgh properties.

Edinburgh Property Prices

During 2023, property values for good quality stock rose steadily again when viewed in the context of localised type-specific properties, e.g 4 bed traditional flats in Marchmont Road. Most stock crept forward only slightly as the cost-of-living crisis, higher interest rates and other factors dampened buyers’ enthusiasm to purchase at higher levels. Typical premiums above ‘offers over’ prices fell to an average of 3.8% versus the previous 8.7% seen in 2022 (source: ESPC). Altogether, not an unsurprising settling of what had been a hot market since the end of the COVID-19 pandemic.

‘Average House prices’ quoted in mainstream media show a drop in values, but this is chiefly due to the lower/smaller end of the market, e.g. 1 and 2 bedroom flats, generating more transactions than the higher value properties which saw fewer sales.

Predictions for capital values in 2024 are likely to show a similar pattern – low-level growth for most areas, probably around 2% - 4%.

Edinburgh remains a very attractive place to live, work and study and that is only likely to increase as the city increases in size and projects like the tram system, segregated cycle network and other developments are rolled out and become part of the fabric of our growing city.

Edinburgh Rental Market

The rental market had another very strong year in 2023.

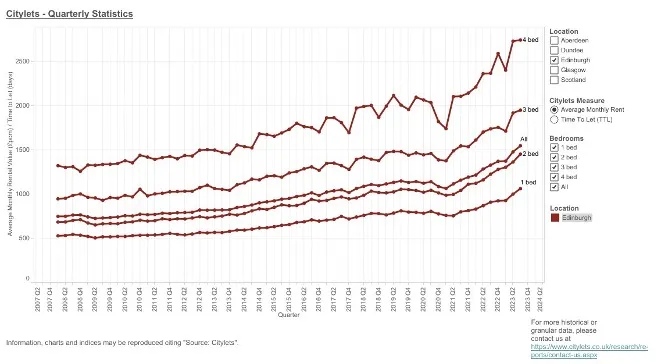

The data shows that rents have increased dramatically in the last three years versus the longer-term typical growth pattern over the previous 12 or so years. Even allowing for, and removing, the COVID year, we see rents growing at around 15% between 2016 and 2019, but jumping to rises of circa 35% between 2020 and the end of 2023.

The graph below shows average rents for different property sizes in Edinburgh since 2008 up to Q3 2023.

Most of the increase is the result of low supply and high demand.

Transaction taxation levels, Additional Dwelling Supplement (6% of purchase value), mortgage payment taxation, increased regulation, rent freezes, etc, have all combined to deter new landlords from entering the buy-to-let market, meaning fewer properties are available. Meanwhile, post-COVID demand has increased as universities returned to full occupancy and attendance levels, workers are more able to work from home, the city is attracting more people as it grows, and the planning system is not expediting or allowing as many new homes being built as the city requires.

As per typical seasonal patterns, demand has eased slightly over the last three months, but it is still strong, and rental values have not decreased. We’d expect them to creep forward again in 2024, but back to the more sensible levels seen in pre-pandemic years.

Edinburgh Student Rental Market

For 2023 we initially expected the demand which had grown throughout 2021 and 2022 to continue, and this was largely how things turned out.

Void periods were low and the student letting season year does now appear to have settled into a pattern of leases ending around the end of May, and new leases commencing in early to mid-June, in those circumstances where there is a whole group move out.

However, whilst we expected there to be a rise in what we call ‘Change of Tenant’ scenarios, whereby some, but not all of the tenants, move out and new ones come in to take their place on a new lease with the existing (staying) tenants, and where there is a seamless non-void transition from one lease to the next, we didn’t expect there to be quite so many. Overall, we had 40% of our managed HMO stock fully vacating, 26% fully staying on in the same group, and 34% with a ‘change of tenant’.

In reality, the focus of the last two years on ensuring that properties are of a good quality and presentation (especially bathrooms and kitchens) meant that any student tenants already in a flat with us were very reluctant to give it up in the midst of a very hot marketplace. Instead, they were very pro-active at finding replacements, who were equally pleased to find a new home which their new-to-be flatmates were recommending to them as a good place to live. A win-win for existing tenants, new joining tenants, and landlords.

We expect a similar pattern for 2024 as the number of well-managed, licensed HMO properties in the city continues to stagnate. There are currently circa 5,000 such homes, down from a previous high about five years ago of circa 7,000. Much of the drop has been due to the high property values causing them to be sold back into the owner-occupier sector.

Rental values have been very strong, and we expect these to increase again in 2024, but the exact levels will depend on what government policy is in place by Spring.